Finance

NEED FINANCE?

There are many finance products on the market today and each dealer may or may not offer the finance plan you are after. Below are some finance options we have available, not all are available with each individual dealer. Always check availability with your local dealer prior to purchase.

Get up to 40 months interest free* at participating dealers, with ZIP Money! Ends 30th of April 2025.

Shop in store at your local dealer, and pay it off interest free with zip money.

Get up to $30,000 financed with ZIP. Talk to your participating dealer to be eligible.

Available to zip approved applicants only from selected Walker Mower dealers.

The smarter way

to pay for what

you want today

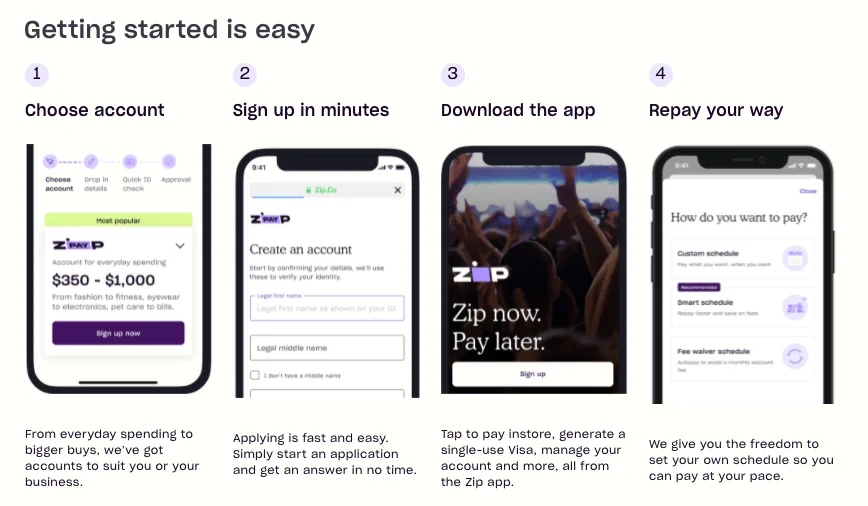

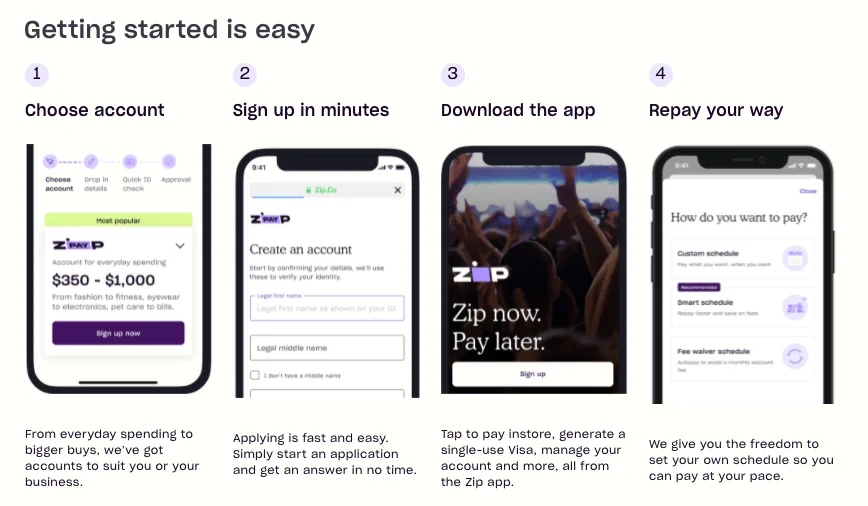

Sign up in minutes

Applying is fast and easy so you can start shopping today!

Interest Free

36 months interest free. No hidden fees or upfront payments.

Flexible repayments

Our flexible repayments put you in control by letting you pay later at your own pace.

Zip is only available at selected Walker Mowers dealers.

Please check zip is accepted as a form of payment prior to purchase.

Contact your local Walker Mowers Dealer to find out more.

More questions?

Here’s a little FAQ to help you get to know Zip better.

What’s the difference between Zip Pay and Zip Money?

Zip Pay is an interest-free buy-now-pay-later service with a credit limit of up to $1000. Repayments are based on a minimum monthly payment from as little as $10 per week. A $9.95 monthly account fee applies, we will waive the fee if you pay your statement closing balance in full, by the due date. With Zip Pay, you can shop everywhere you see the Contactless Symbol when you add your Zip card to your Apple or Google wallet.*

Zip Money is a line of credit with credit limits between $1,000 and $3000 for regular accounts and up to $50,000 for specific merchants. Zip Money offers customers a guaranteed interest-free period of 3 months across all products and up to 36 months with some retailers. Zip Money accounts may incur a one-off establishment fee for certain credit limits. A $9.95 monthly account fee applies.

Both products also feature our Shop Everywhere card, which you can use at any online retailer that accepts Visa**.

Is Zip suitable for everyday purchases?

Zip is perfect for everyday purchases and offers the ability to transact just about everywhere, so you can manage all your expenses in one place and repay on a schedule that suits you.

To shop instore, Zip Pay users can checkout using Tap & Zip.* To get started with Tap & Zip, simply navigate to the Zip app and click on the card icon in the bottom menu. From there, you will be able to generate a multi-use Tap & Zip card and add it to your Apple Pay or Google Pay wallet.

To shop online, use the Zip mobile app and generate a single-use card at the checkout anywhere Visa is accepted.

Where can I shop with Zip?

See the full list where you can shop with Zip: https://zip.co/au/shop

Shop everywhere online where Visa is accepted with Zip's single-use card feature on the Zip mobile app. Or shop anywhere instore you see Zip at checkout - we’re partnered with 32,000+ retail stores.

Additionally, you can use your Zip account to pay BPay bills and buy gift cards for food, fuel and subscriptions

How do repayments work?

If you return goods to a retailer and they agree to a refund, your Zip account will be credited with the agreed refund amount. The funds will then be put towards your owing balance or depending on the refund amount your account may be placed in credit.

How can Zip help with my business?

Zip Business solutions can help your business grow.

Boost your sales by accepting Zip Payments.

Control your cashflow with Zip Business Trade, which gives you up to $3,000 to cover your business expenses, invoices and utility bills now, and pay us back later once you get paid.

Zip Business Capital can take your business to the next level with a line of credit up to $500k you could invest in equipment, inventory, staff, or new market growth.

Is Zip a buy now, pay later like Afterpay, Klarna, Humm and Latitude?

Yes! However, Zip allows you to shop just about everywhere, online and instore. We give you the flexibility to set your repayment schedule to suit your lifestyle – choose weekly, fortnightly, or monthly. You can also pay your bills, manage your subscriptions, buy gift cards and earn rewards when you use the Zip app.

Minimum monthly repayments are required. Paying only the minimum monthly repayment amount will not pay out the purchase within the interest free period. Any balance outstanding at the expiry of the interest free period for the purchase will be charged interest at the contractual rate, currently 19.9%. A $6 monthly account fee applies. A one-off establishment fee may apply.

Available to approved applicants only. Terms & Conditions apply and are available on application. See your contract for further details. Credit provided by zipMoney Payments Pty Limited (ABN 58 164 440 993, Australian Credit Licence Number 441878).

Are you wondering if it’s a good time to upgrade/buy new equipment or tools for your business?

With FINAPPS Asset Finance options you can finance more than you might have thought.

SME Mowers (parent company of the Walker Mowers Australia brand) is now an approved Supplier on LGP (Local Government Procurement)! This means that all brands distributed by SME Mowers can be purchased by councils & government departments in NSW without going through the tender process.

LGP focuses on creating procurement efficiencies and building procurement expertise, saving councils significantly in time and dollars.

SME Mowers (parent company of the Walker Mowers Australia brand) is now an approved Supplier on Local Buy! This means that all brands distributed by SME Mowers can be purchased by councils & government departments in QLD and NT without going through the tender process.

Local Buy focuses on creating procurement efficiencies and building procurement expertise, saving councils significantly in time and dollars.